The market loved the productivity number today. It's not clear how the 9% number comes out of the eight inputs (presumably by some weighting and then forming the appropriate ratios) but it's clear that the output per hour number looks very good:

However, the data show that Output per hour only increased so much because while both output and hours worked declined, hours worked declined even more. Production shows the by now classic green shoots phenomenon: Sure, it's declining, but it's declining at a slower pace.

Production shows the by now classic green shoots phenomenon: Sure, it's declining, but it's declining at a slower pace.

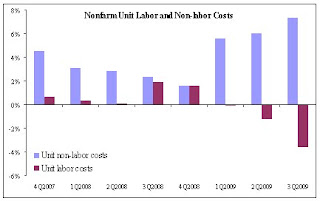

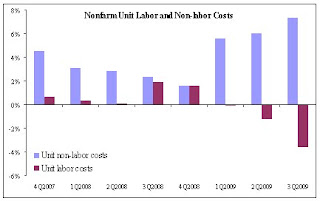

We can also see that we're not really cutting costs by that much more, depending on the capital to labor mix in the production function. While labor costs are falling, non-labor costs are rising even faster.

It seems too easy an explanation that market participants don't look into these numbers and only look at the headline number but to me this is not reason to shrug off e.g. the CIT bankruptcy and believe the economy is humming along now. Production is still slowing and people work less, which does not spell well for future demand. Is a weak dollar really enough to sustain production and turn it around?

It seems too easy an explanation that market participants don't look into these numbers and only look at the headline number but to me this is not reason to shrug off e.g. the CIT bankruptcy and believe the economy is humming along now. Production is still slowing and people work less, which does not spell well for future demand. Is a weak dollar really enough to sustain production and turn it around?

Production shows the by now classic green shoots phenomenon: Sure, it's declining, but it's declining at a slower pace.

Production shows the by now classic green shoots phenomenon: Sure, it's declining, but it's declining at a slower pace. We can also see that we're not really cutting costs by that much more, depending on the capital to labor mix in the production function. While labor costs are falling, non-labor costs are rising even faster.

It seems too easy an explanation that market participants don't look into these numbers and only look at the headline number but to me this is not reason to shrug off e.g. the CIT bankruptcy and believe the economy is humming along now. Production is still slowing and people work less, which does not spell well for future demand. Is a weak dollar really enough to sustain production and turn it around?

It seems too easy an explanation that market participants don't look into these numbers and only look at the headline number but to me this is not reason to shrug off e.g. the CIT bankruptcy and believe the economy is humming along now. Production is still slowing and people work less, which does not spell well for future demand. Is a weak dollar really enough to sustain production and turn it around?

No comments:

Post a Comment