Friday, November 6, 2009

Unemployment by Education

It would be interesting to see where GDP comes from, how much of GDP is produced by which educational stratum. The reason why it's interesting is that people with high school but no college, the lowest stratum measured, have, not surprisingly, shouldered most of the surge in unemployment. The gap in unemployment between people with a bachelor's or higher and people with only high school has increased pretty much in the same shape as the level in unemployment for people with only highschool as increased (see the two green lines in the figure below--click on it to see the graph better.) Unemployment for people with a bachelor's degree has actually declined in October.

Thursday, November 5, 2009

Productivity again

The market loved the productivity number today. It's not clear how the 9% number comes out of the eight inputs (presumably by some weighting and then forming the appropriate ratios) but it's clear that the output per hour number looks very good:

However, the data show that Output per hour only increased so much because while both output and hours worked declined, hours worked declined even more. Production shows the by now classic green shoots phenomenon: Sure, it's declining, but it's declining at a slower pace.

Production shows the by now classic green shoots phenomenon: Sure, it's declining, but it's declining at a slower pace.

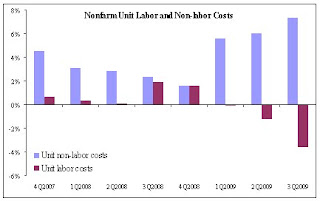

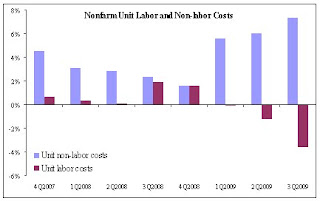

We can also see that we're not really cutting costs by that much more, depending on the capital to labor mix in the production function. While labor costs are falling, non-labor costs are rising even faster.

It seems too easy an explanation that market participants don't look into these numbers and only look at the headline number but to me this is not reason to shrug off e.g. the CIT bankruptcy and believe the economy is humming along now. Production is still slowing and people work less, which does not spell well for future demand. Is a weak dollar really enough to sustain production and turn it around?

It seems too easy an explanation that market participants don't look into these numbers and only look at the headline number but to me this is not reason to shrug off e.g. the CIT bankruptcy and believe the economy is humming along now. Production is still slowing and people work less, which does not spell well for future demand. Is a weak dollar really enough to sustain production and turn it around?

Production shows the by now classic green shoots phenomenon: Sure, it's declining, but it's declining at a slower pace.

Production shows the by now classic green shoots phenomenon: Sure, it's declining, but it's declining at a slower pace. We can also see that we're not really cutting costs by that much more, depending on the capital to labor mix in the production function. While labor costs are falling, non-labor costs are rising even faster.

It seems too easy an explanation that market participants don't look into these numbers and only look at the headline number but to me this is not reason to shrug off e.g. the CIT bankruptcy and believe the economy is humming along now. Production is still slowing and people work less, which does not spell well for future demand. Is a weak dollar really enough to sustain production and turn it around?

It seems too easy an explanation that market participants don't look into these numbers and only look at the headline number but to me this is not reason to shrug off e.g. the CIT bankruptcy and believe the economy is humming along now. Production is still slowing and people work less, which does not spell well for future demand. Is a weak dollar really enough to sustain production and turn it around?Is greater productivity really good news?

This morning the Dept. of Labor released its productivity numbers. Productivity was up 9.5% after it was up 6.6% last quarter. Output per hour was up 4.3% while output was down but hours worked was down even more and a shift has happened from labor-intensive processes to capital-intensive processes as evidenced by falling unit labor costs and quickly rising unit non-labor costs. The market took it well and rallied on the productivity number. Apparently the economy can keep (or get back to) humming even with high unemployment. But firms only want to produce if there is demand for goods.

- why keep producing more if unemployment is high and demand is lacking?

- In this environment, where can we see demand coming from?

- Is the low dollar enough to make US exports so competitive that they can support aggregate demand in the US to push production high enough until increased productivity can't take care of demand anymore and you need to hire people back (who will then create demand themselves)?

- Is the market correct in viewing the higher productivity as positive?

A more detailed understanding of the literature on the real business cycle coudl certianly be useful.

- why keep producing more if unemployment is high and demand is lacking?

- In this environment, where can we see demand coming from?

- Is the low dollar enough to make US exports so competitive that they can support aggregate demand in the US to push production high enough until increased productivity can't take care of demand anymore and you need to hire people back (who will then create demand themselves)?

- Is the market correct in viewing the higher productivity as positive?

A more detailed understanding of the literature on the real business cycle coudl certianly be useful.

Subscribe to:

Posts (Atom)